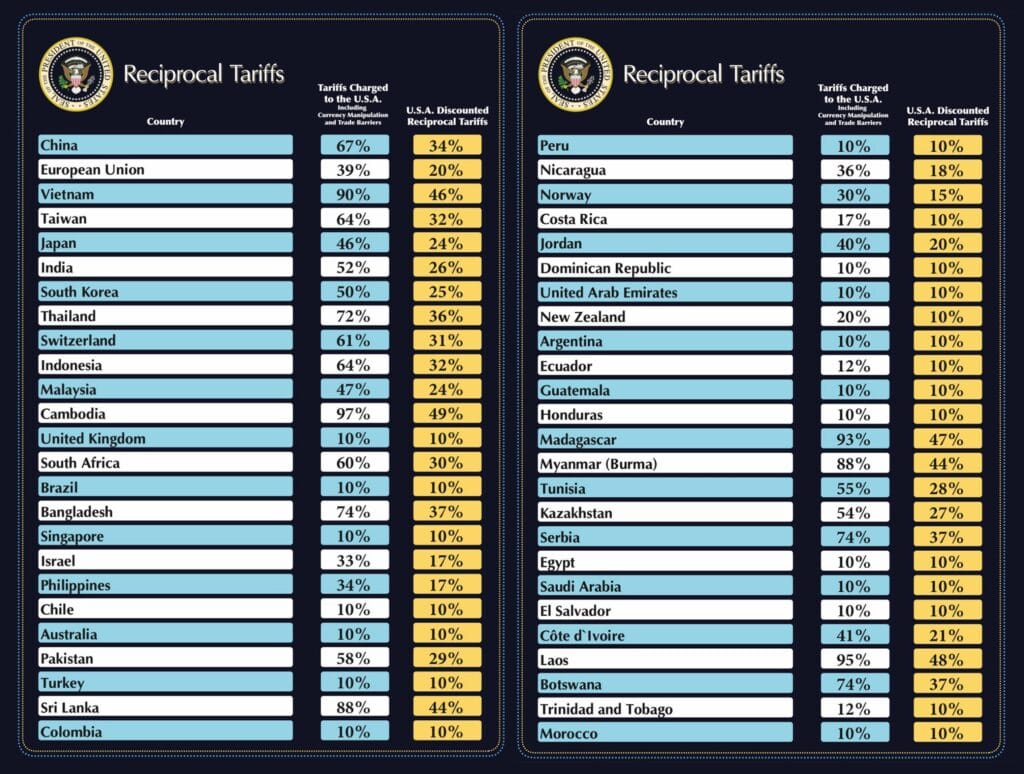

On April 2, 2025, U.S. President Donald Trump unveiled a bold new trade policy, announcing reciprocal tariffs on over 100 countries, including India, in a move he dubbed a “rebirth” of American industry. The White House released a detailed list of nations facing these tariffs, marking a significant shift in U.S. trade strategy aimed at leveling the playing field. Trump’s policy introduces a mix of “discounted reciprocal tariffs”—half the rate imposed by other countries on U.S. goods—and a universal 10% baseline tariff, with some nations facing even steeper duties. Below, we explore the policy’s intricacies, its global ramifications, and what it means for the U.S. economy and beyond.

Trump’s Vision: “Liberation Day” for American Industry

In a fiery address, President Trump framed the tariffs as a long-overdue correction to decades of exploitation by foreign nations. “Today is Liberation Day. America has been waiting for this day for a long time,” he declared. “For the last 50 years, our taxpayers have been cheated. But that won’t happen anymore.” He accused countries worldwide of “looting” the U.S. through unfair trade practices, positioning the tariffs as a reclaiming of economic sovereignty. The executive order, signed on Wednesday, April 2, 2025, sets the stage for immediate and phased implementation, with ripple effects already felt across global markets.

How Reciprocal Tariffs Work: The India Example

The White House highlighted India as a key target, noting that India imposes a 53% tariff on U.S. goods. In response, the U.S. will levy a 26% tariff on Indian imports—a “discounted reciprocal” rate, half of India’s duty. Trump singled out India during his announcement, recalling a recent visit from the Indian Prime Minister. “He’s a very good friend of mine,” Trump said, “but I told him, even though you’re my friend, you’re doing injustice to my country.” He emphasized the disparity, pointing out that the U.S. had historically imposed little to no tariffs on Indian goods, a practice he aims to end.

This discounted approach applies to many of the 100+ countries listed, though some face full reciprocal rates or additional penalties, reflecting Trump’s intent to tailor the policy to specific trade relationships.

Implementation Timeline: When Tariffs Take Effect

The tariff rollout is structured in phases:

- April 3, 2025 (12:01 a.m. U.S. time): A 25% tariff on all foreign-made automobiles kicks in, targeting a key import sector.

- April 5, 2025 (12:01 a.m. U.S. time): A 10% baseline tariff applies to all countries unless otherwise specified.

- April 9, 2025 (12:01 a.m. U.S. time): Higher reciprocal tariffs (above 10%) take effect for designated nations.

This staggered approach allows businesses and markets some adjustment time, though the immediate auto tariff signals Trump’s urgency in protecting U.S. manufacturing.

President Trump Participates in the Make America Wealthy Again Event https://t.co/CDX2abcJ7J

— The White House (@WhiteHouse) April 2, 2025

Global Market Shockwaves: Stocks Fall, Gold Soars

The announcement triggered immediate economic turbulence. Asia-Pacific stock markets plummeted, with Japan’s index dropping 4% and Australia’s falling 2%. Analysts predict broader volatility as countries assess the tariffs’ impact on exports to the U.S., a major consumer market. Conversely, gold prices surged to a record high, reflecting investor uncertainty and a flight to safe-haven assets. The U.S. stock market’s response remains mixed, with domestic manufacturers potentially benefiting while import-reliant sectors brace for higher costs.

The 10% Baseline Tariff: Who’s Affected?

While Trump initially signaled a universal 10% tariff, the final policy applies this baseline only to select nations with relatively balanced trade ties. These include:

- United Kingdom

- Singapore

- Brazil

- Australia

- New Zealand

- Turkey

- Colombia

- Argentina

- El Salvador

- United Arab Emirates

- Saudi Arabia

For others, higher reciprocal rates reflect greater perceived trade imbalances, a nuance that has sparked debate over the policy’s fairness.

Highest Tariffs: Targeting Trade Giants

The heaviest duties target countries with significant tariffs on U.S. goods. Among the 60 nations facing elevated rates:

- European Union: 20%

- China: 34%

- Vietnam: 46%

- Thailand: 36%

- Japan: 24%

- Cambodia: 49%

- South Africa: 30%

- Taiwan: 32%

These rates aim to mirror—or slightly undercut—the tariffs these countries impose on the U.S., though critics argue they risk escalating into a full-blown trade war.

Canada and Mexico: A Temporary Reprieve

Notably absent from the new tariff list are Canada and Mexico, U.S. neighbors and partners under prior trade agreements. The White House clarified that existing arrangements, adjusted after Trump’s earlier 25% tariff threats (later reduced), will govern trade with these nations. This exemption, tied to concerns over fentanyl and border security, suggests a strategic softening toward North American allies—at least for now.

Auto Industry in the Crosshairs: 25% Tariff Hits Hard

The 25% tariff on foreign-made cars, effective April 3, 2025, targets a cornerstone of U.S. imports. With millions of vehicles entering the country annually from Japan, Germany, and beyond, prices are expected to rise sharply—by $4,000 to $10,000 per car, per early estimates. This move aligns with Trump’s promise to bolster domestic automakers, though it may strain consumers already grappling with inflation.

World Leaders React: Fears of a Trade War

Global leaders wasted no time voicing concerns. Italian Prime Minister Giorgio Meloni warned of an impending trade war, calling the tariffs “unfair” and pledging to seek a diplomatic resolution. “Such a trade war will weaken Western countries,” she cautioned. Australian Prime Minister Anthony Albanese echoed this sentiment, labeling the tariffs “completely wrong” and a betrayal of U.S.-Australia ties. The chorus of dissent hints at potential retaliatory measures, despite U.S. warnings against such actions.

Everyday Costs: What Gets More Expensive?

The tariffs will hit U.S. consumers’ wallets, with price hikes looming for:

- Cars: Up to $10,000 more per vehicle.

- Alcohol: European champagne, German beer, and Mexican imports like Modelo and Corona will cost more.

- Fuel and Food: Imported oil, maple syrup, and avocados face upward pressure.

These increases could fuel inflation debates, challenging Trump’s narrative of economic renewal.

U.S. Warning: “Don’t Retaliate”

Treasury Secretary Scott Vincent issued a stern message to affected nations: “My advice is not to retaliate. Sit back, watch what happens next. If you retaliate, this will get worse.” The admonition underscores the U.S.’s confidence in its economic leverage, though it may provoke defiance from trade partners unwilling to absorb the new costs quietly.

Broader Implications: A New Era of Protectionism?

Trump’s tariffs signal a return to protectionism, reviving a playbook from his first term but with greater scale and specificity. Proponents argue it will revitalize U.S. manufacturing and reduce trade deficits, while detractors warn of disrupted supply chains, higher consumer prices, and strained alliances. As the policy unfolds, its success will hinge on whether short-term economic pain yields long-term gains—or spirals into a global trade standoff.

This expanded analysis delves into the motivations, mechanics, and fallout of Trump’s reciprocal tariffs, offering a comprehensive look at a policy poised to reshape international commerce in 2025 and beyond.

Hope you liked this information. Do not forget to share this article.

For more in-depth insights and the latest updates on Indian Politics, Finance, Science, Sports, Entertainment, health, technology, Digital Marketing and more, be sure to explore our other articles at www.indiatics.com, Stay informed and stay ahead with the most relevant news and expert analysis!